how much can you get a payday loan for

Go back home financing pre-acceptance on line when you look at the three strategies

Article summary

- Pre-acceptance features you a strong concept of what you are able afford, enabling you to household look with certainty. You can buy pre-acknowledged on the web by using devices for instance the ooba Bond Signal, that provides a fast, easy, Do-it-yourself, user-amicable experience.

- The text Signal will payday loan Waterloo require that enter specific factual statements about your bank account, which it use to determine their affordability, and estimate the size of the home loan you are more than likely to be eligible for.

- It will manage a credit score assessment, to decide your credit rating.

- Since the procedure is complete, you are awarded that have good prequalification certificate, which shows vendors your a critical client.

It is best to be prepared, specially when and then make a financial relationship because high once the that of purchasing a home. This is how delivering mortgage pre-acceptance on line can help you streamline the house-to invest in procedure.

As to the reasons get home financing pre-acceptance on line?

Financial pre-approval need you to read a prequalification techniques, where you bring specific economic pointers, which is after that accustomed estimate the size of our home loan your likely qualify for. You’ll also get your credit rating as an ingredient of the prequalification processes.

It may seem such as for instance way too many most work, however it is extremely beneficial to fully grasp this suggestions nowadays. Listed below are some reason as to the reasons prequalification is within their best interests:

- It offers you having an idea of what you could manage, so you can household have a look confidently. You don’t want to decide on a specific home shortly after a good long search, just to see later on you can’t afford it.

- It provides you along with your credit history, that the finance companies use to choose exactly how much from good risk you are. Your credit rating suggests on lender if for example the previous financial obligation fees conduct can make you an effective exposure or otherwise not.

- It offers your which have a good prequalification certification, which you are able to then show a home agent to prove you complete your research and that you indicate organization.

- Owner of the house is much more probably conduct business which have an individual who currently features an effective signal, in the form of pre-acceptance, that they may afford the domestic.

You’ve got the accessibility to getting in touch with a lender or thread originator truly and getting pre-passed by a specialist, but it’s smaller, simpler and much easier to do it on the web on your own. Listed below are around three simple steps so you can doing so:

step 1. Look for a mortgage evaluation solution

A home loan review service will always provide the solution to apply for pre-approval, many home loan analysis providers much more top-notch as opposed to others. Since they also can connect with several banks having a home mortgage on your behalf, you will need to favor a home loan investigations solution who may have good reference to banking institutions that is ready to struggle the part when settling that have banking institutions.

With regards to prequalification, you truly need to have an assistance that makes the method basic easy. Including, ooba lenders, that’s Southern area Africa’s top mortgage assessment provider, provides a totally free, Doing it yourself, online equipment, the bond Founder, which will take your from the pre-approval process detailed, from the comfort of your own home.

2. Let them have the desired guidance

The latest pre-approval techniques will demand you to promote individual and you may monetary information that will allow the fresh new prequalification device so you’re able to determine their affordability, and also to check your credit score.

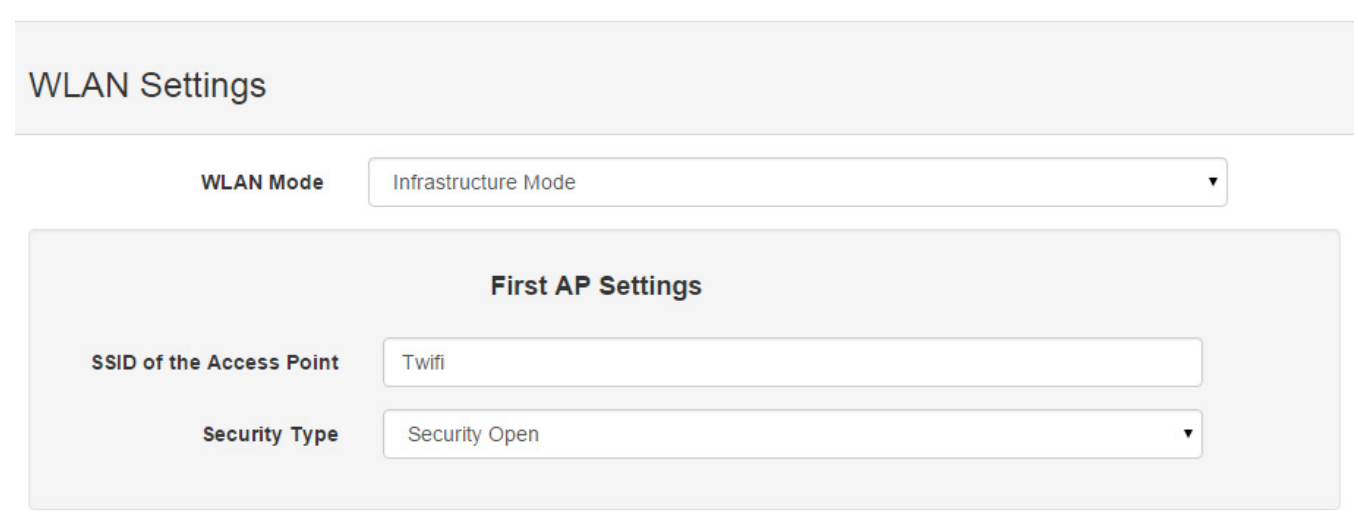

- Discover the ooba Thread Indication: indicator.ooba.co.za

step 3. Prequalification certificate

Once you are complete, you might be issued which have an effective prequalification certification, that you can present to a house representative or domestic vendor. This new certificate holds true to own 3 months, after which you will be called of the home loan comparison service making sure that your financial situation hasn’t altered by any means, ahead of providing you with the choice to help you prequalify once again.

Bear in mind that this new prequalification certificate doesn’t make certain the lending company offers home financing. They will certainly still need to carry out her affordability and borrowing from the bank inspections, and assess the property you’ve decided to get so they can take its value into account.

But using pre-recognition, there are chosen property more likely to slide in this debt setting, which means that improve your chances of obtaining a mortgage. As you will additionally understand your credit rating, you can select if or not you need to manage enhancing your credit score before you apply to have a home loan.

Making an application for a mortgage

Once you’ve acquired pre-accepted, and discovered property that’s inside your function, you might enlist the services of home financing investigations solution such as for instance ooba lenders to submit an application for a good financial. Simply because they connect with several financial institutions for you and evaluate rates of interest, they may safe a mortgage deal in addition to this than the one your thought you’ll get centered on the pre-approval.

Nevertheless they offer a selection of products that make your house purchasing procedure much easier. Start by their bond calculator; up coming use its free, online prequalification product, brand new ooba Thread Indication, to acquire prequalified and view what you are able afford. Eventually, when you’re ready, you could potentially sign up for home financing.