how much is a payday loan

Charleston Virtual assistant Mortgage Limits and Most recent Condition

First Sidebar

We. Bill. For these earlier in the day and provide army who do meet the requirements, around actually is no more sensible choice in today’s home loan market for 100% financing.

The latest Virtual assistant loan is only available to a small number of. Having pros of your army, this new Va home loan is an option. Thus too is actually energetic-responsibility soldiers with at the least 181 times of services, individuals with no less than half dozen many years of provider about Federal Guard or Armed forces Reserves and you may surviving spouses of those who have died while in solution otherwise down seriously to good service-associated burns off.

Approved Virtual assistant loan providers eg Coastline 2 Coast Lending can also be examine a beneficial borrower’s Virtual assistant qualifications through an immediate consult to your Agency of Veteran’s Factors getting a copy of Certification off Eligibility. That it certificate ‘s the only file the latest Va will accept whenever lenders process an excellent Virtual assistant home loan to determine if the borrower is indeed entitled to the mortgage system.

The new Virtual assistant financial does not require a downpayment at all that is certainly around three government-recognized home loan applications in the present marketplaces. Past perhaps not demanding a deposit, the brand new Va forbids the fresh experienced out of expenses certain types of closing costs.

Attorneys or escrow costs, such as for example, are believed non-deductible. The new borrower is permitted to purchase an assessment statement, borrowing query, term insurance rates, origination fees, recording and a house survey. Any other fees have to be taken care of from the vendor or the lending company. The financial institution can also to alter the rate into financing then question a lender credit at settlement dining table.

New Va home loan in addition to deal a guarantee into bank. If the loan ever enter property foreclosure, the fresh new Virtual assistant pays the lending company 25% of losses for the financing. So it make certain is financed about what is known as the fresh new Capital Commission which can be calculated just like the a portion of your loan amount. That it capital fee can vary reliant a few items but having an initial-date household visitors getting $0 upon a thirty-seasons Virtual assistant home loan, the new investment payment try 2.15% of your own conversion cost of your house.

The newest funding commission develops to three.3% to own consumers with used the Va financing system, but can getting quicker by putting about 5% off at closing. Understand the complete money commission chart lower than.

Believe a house for the Charleston listed at $250,000. The customer and you may merchant agree with the purchase price together with bank proceeds to your loan application. Brand new money payment contained in this analogy in the 2.15% of one’s transformation price is $5,750 but does not have to be paid to have regarding wallet that is most often rolling for the loan amount, remaining the money to close also straight down.

Virtual assistant mortgage brokers do not require a monthly home loan insurance rates fee (PMI) like other FHA and you can USDA bodies money. The attention cost on Virtual assistant fund are very aggressive, indeed, some of the lower on the market. Those two has produce less complete monthly payment as compared to other kinds of home loans.

New Virtual assistant program as well as necessitates the homebuyer to help you occupy new house and should not utilize the Virtual assistant financing to buy accommodations property otherwise a moment household. The newest Va mortgage can also be used to finance unmarried-family unit members land, approved condos and you can townhomes that is holder-occupied.

Brand new Va loan limits having 100% resource are $766,550 when you look at the South carolina and most of the nation, except higher-rates metropolises. This type of constraints will likely be surpassed, however, the home client may have to set currency off.

Getting current people that might be considering a refinance, Va has the benefit of rate of interest protection and also 100% cash-aside re-finance applications for property owners having security. Rates is actually near every-time lows and house equity is near most of the-date levels. Now might be a great time to help you make use of your property collateral to assist combine highest-attract debt first off an important home redesign project, etcetera.

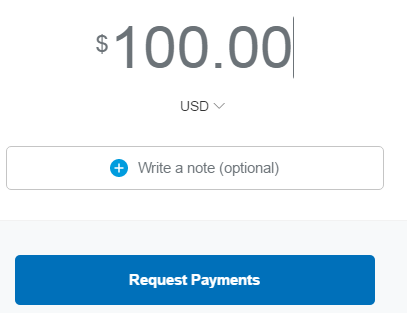

Zero advance payment, lower closing costs and you can aggressive rates generate a compelling circumstances for these attempting to reach the fresh new closing table with because the nothing cash that you can. Contact us now by complete the brand new Short Demand Form about page.

Possess Questions?

Our knowledgeable mortgage officers is actually would love to help you with all of home loan needs seven days a week. Delight fill in the fresh Brief Request Form less than that have any questions.